Keeping social insurance efficient and affordable

Calling for more and more tax and contribution money cannot be a solution in view of the record burdens already being placed on citizens and companies.

Johannes Vogel,

Deputy Federal Chairman of the FDP and First Parliamentary Secretary

of the FDP parliamentary group in the Bundestag

Source: FAZ from June 4, 2023

We need a social security brake and a clear roadmap on how contribution rates can be limited to below 40% again. There is hardly any other country where employees are left with so little of their earned income as in Germany. The high social security contributions in particular are responsible for the fact that employees are left with so little net income: For single average earners, around €33.59 in social security contributions are currently due for every €100 gross wage: (€16.65 for the employer and €16.94 for the employee). For every €100, the employee must also pay €14.71 in income tax (OECD Taxing Wages, 2023). Only by reliably limiting social security contributions will Germany be able to remain competitive in the long term and the jobs of tomorrow will be created here. The sharp rise in outflows of investment capital from Germany is already a warning signal that Germany is becoming less attractive as a business location. Around 132 billion dollars (125 billion euros) more direct investment flowed out of Germany in 2022 than was invested in the Federal Republic in the same period. This sum represents the highest net outflows ever recorded in Germany.

©AdobeStock Nattapol_Sritongcom

Overall social security contribution rate threatens to rise sharply

The already high burden on wages and salaries is expected to increase significantly in the coming decades. Based on current legislation, the contribution rate could rise to as much as 53% by 2040. This creates massive risks for international competitiveness and economic development in Germany with unfavorable effects on employment and jeopardizes the fair balance between the generations involved. This is shown by numerous reports, including the report by the BDA Commission on the Future of Social Security headed by Professor Dr. Werding (Ruhr University Bochum) and the report by the Scientific Advisory Board to the Federal Ministry of Economics and Climate Protection on the sustainable financing of care services.

It is 0.85 after 12

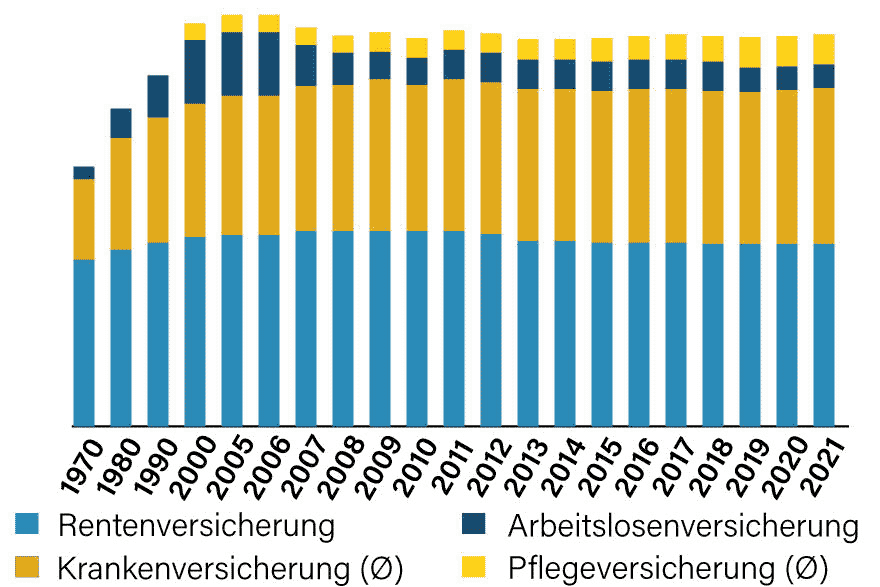

As of July 1, 2023, the contribution rates for pension, health, unemployment and long-term care insurance will add up to 40.8% - and even 41.4% for insured persons without children. This is the first time in ten years that they have exceeded the 40% mark. Compared to the previous year, the contribution burden increased by 0.85 percentage points because not only did the supplementary contribution rate for health insurance increase, but the long-term care insurance contribution rate was also raised as of July 1, 2023. The temporary reduction in the unemployment contribution also increased at the beginning of the year.

Total social security contribution

According to Section 28d SGB IV, the total social insurance contribution includes all contributions based on pay to the social insurance branches jointly financed by employees and employers, i.e. pension, health, unemployment and long-term care insurance. The average additional contribution in statutory health insurance (1.6%) and the additional contribution for childless persons in social long-term care insurance (0.6%), which was introduced on January 1, 2005 and has been increased since July 1, 2023, are therefore also part of the total social insurance contribution.

We need a clear roadmap for limiting contribution rates to below 40% again. We also need an awareness of long-term thinking and sustainable decisions in social insurance. As with the 1.5 degree target in climate policy, we need a tangible sustainability target for social insurance. A stop sign in the form of an upper limit for social security contributions can make a significant contribution to this. Once a year, the federal government should also submit a report on the sustainability of our social security systems. This strengthens transparency, promotes debates on reform and encourages long-term decisions.

The BDA therefore advocates - in its policy positions, statements and publications - concentrating the benefits of all branches of social insurance on a basic level of security and having individuals finance any entitlements that go beyond this themselves. This is possible without compromising social security and without overburdening those affected financially, especially as decreasing compulsory contributions also create additional room for maneuver.

The relationship between solidarity and subsidiarity must be brought back into an appropriate balance. The community of solidarity should only step in where individuals are unable to help themselves on their own. A stronger emphasis on the principle of subsidiarity not only creates more fairness in terms of performance, but also keeps the welfare state financially viable in the long term.

Social benefits continue to rise

Compared to 2021, social expenditure (benefit expenditure) increased by 2.2% in 2022. In relation to gross domestic product (GDP), which rose by 7.4% to €3,869.9 billion last year, this results in a social benefits ratio of 30.5% (2021: 32.0%). However, this development is by no means reassuring. GDP rose particularly strongly as the coronavirus crisis subsided and after the 2% drop (2020) (2021: 5.8% and 2022: 7.4%). The falling social benefit ratio is therefore not the result of a frugal state.

In fact, even before the current crises (coronavirus aftermath, war in Ukraine, demographic change and climate crisis), the welfare state was growing at a disproportionately high rate - despite a long upturn and record employment. This makes it all the more important now that solidarity and subsidiarity - with a view to sustainable and intergenerationally just policies - must be brought back into an appropriate relationship.

Links and PDFs on the topic

Explanatory video on the topic:

Comply with the 40% upper limit for social contributions

Facts and figures

Employers support the welfare state

According to the federal government's social budget, employers' share of funding for all social benefits (33.8%) was lower than that of the state (34.1%) and higher than the social contributions of insured persons (30.4%). Since the coronavirus crisis and the need for additional financing by the state for compensation, vaccines and testing, among other things, the state has been slightly ahead of employers in terms of financing expenditure. However, with the expiry of the last coronavirus measures, it is assumed that employers will once again become the largest financiers of the welfare state.