The future of social security

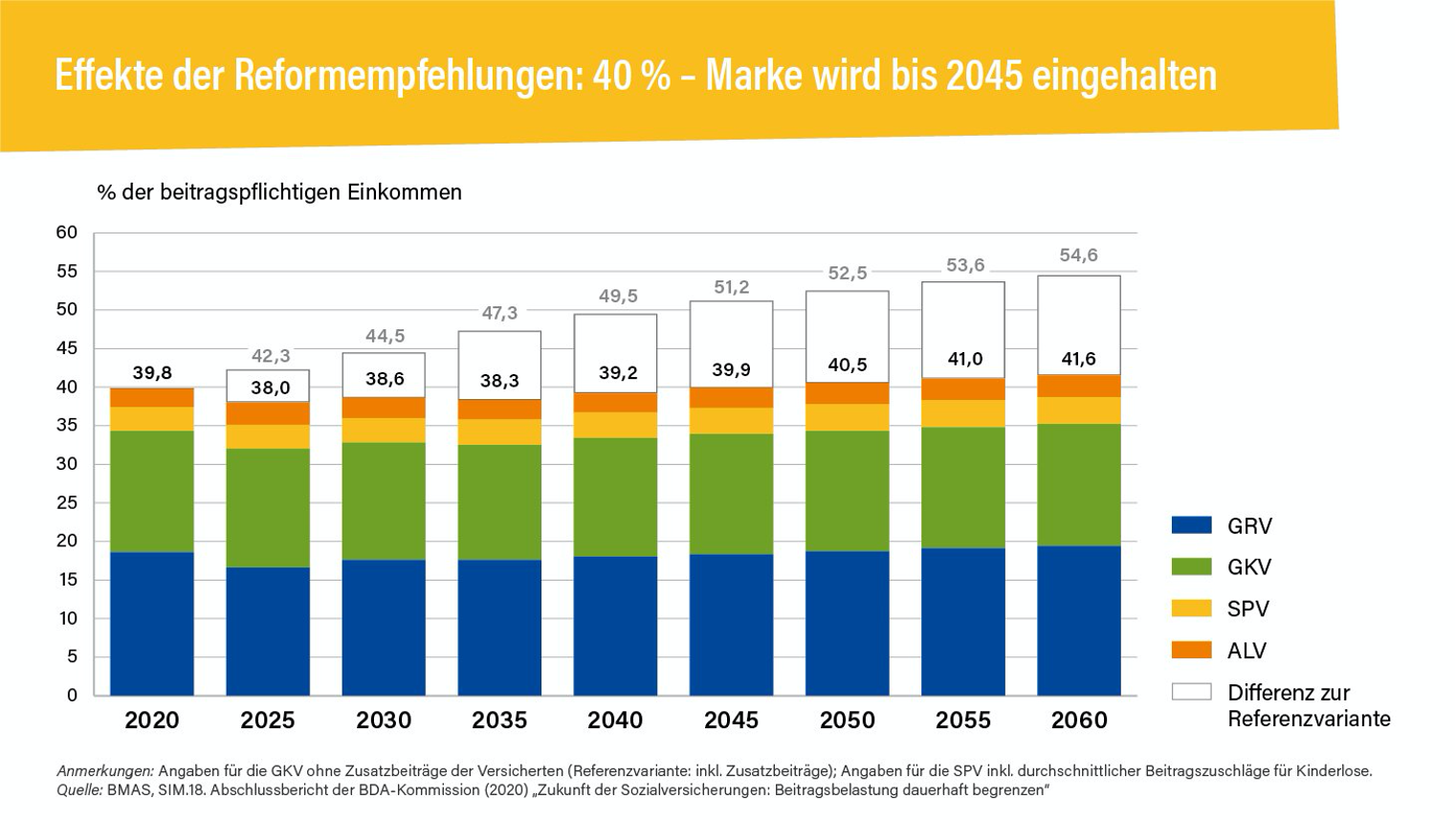

In February 2019, the Confederation of German Employers' Associations set up a commission on "The Future of Social Security: Permanently Limiting the Contribution Burden "*. Under the leadership of Professor Dr. Werding (Ruhr University Bochum), this commission has developed proposals on how the total contribution rates of the statutory social insurance funds can be kept below 40 percent in the long term.

©AdobeStock William W. Potter

In particular, the Commission recommends the following measures to limit social contributions on a permanent basis:

- Extending the active phase of life: automatic linking of the standard retirement age to life expectancy

- Abolish early retirement without deductions

- Increase deductions and supplements in the event of early or later retirement

- Strengthen sustainability factor

- Fully finance non-contributory benefits from the federal budget

- Enable stricter care management based on selective contracts between health insurance funds and physicians and hospitals

- Change hospital demand planning, introduce monistic hospital financing by SHI and provide tax funds for the necessary investments

- Offer SHI tariffs with care management as optional tariffs and levy additional contributions for other SHI tariffs that are independent of the insured person's income.

- Introduce sustainability factor for adjustments to care benefits

- Strengthen the character of unemployment insurance as a risk insurance financed by contributions, e.g. limit the maximum duration of claims to unemployment benefits to twelve months.

*The BDA Commission is a body of academia and business chaired by Prof. Dr. Martin Werding (Ruhr University Bochum), co-chaired by Ms. Heide Franken (former Managing Director at Randstad Germany, former BDA Executive Committee member). Further members are: Mr. Bertram Brossardt (vbw - Chief Executive Officer), Ms. Prof. Dr. Tabea Bucher-Koenen (ZEW and University of Mannheim), Mr. Prof. Dr. Michael Hüther (IW Cologne), Mr. Steffen Kampeter (BDA Chief Executive Officer), Mr. Prof. em. Dr. Dr. h.c. Wolfram Richter (Technical University of Dortmund), Mr. Holger Schwannecke (ZDH Secretary General) and Mr. Oliver Zander (Managing Director of Gesamtmetall).