Tax policy

An internationally competitive tax system is a must for every government. Now that Germany has become a high-tax country for companies, it needs competitive tax rates again. Additional financial or bureaucratic burdens, on the other hand, would be misguided. A modern tax system makes a significant contribution to economic recovery after the coronavirus crisis and promotes innovation and employment in the long term. Increasing taxes or levies, on the other hand, would be a misguided approach that is detrimental to growth and innovation.

Photo: AdobeStock everythingpossible

Modern tax policy for greater competitiveness

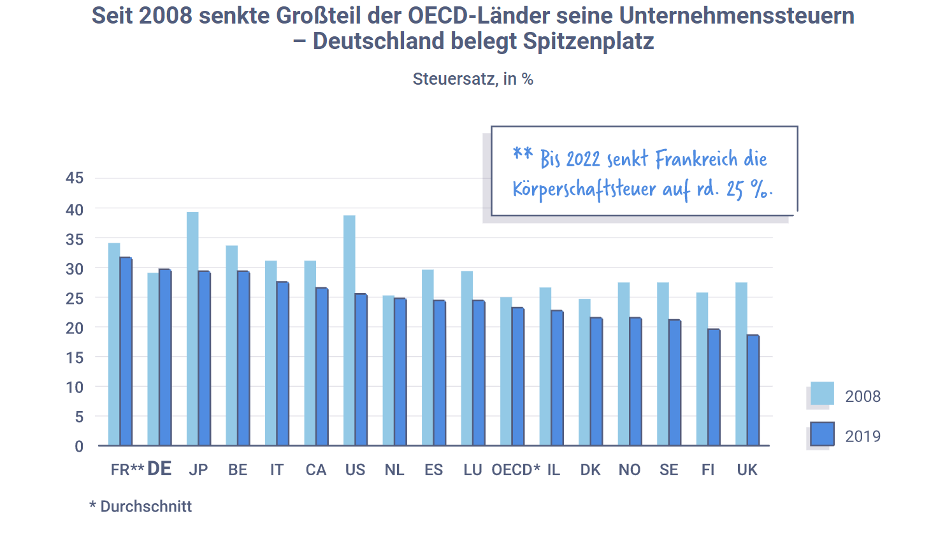

Since the last fundamental reform of corporate tax law in 2008, the German tax system has become increasingly less competitive internationally. With a tax burden of around 30% for corporations, Germany is well above the OECD average. For partnerships, income tax is decisive, which means that the burden can be even higher at the top.

Tackling tax reform - promoting growth, employment and investment

In order to realize new growth prospects, it is necessary to create entrepreneurial scope for action and remove obstacles to growth. The traffic light coalition must put the competitiveness of Germany as a business location on its agenda. The necessary tax reform would give companies additional incentives to invest and increase employment. For example, the complete abolition of the solidarity surcharge would be an initial relief for companies. After all, companies generate more than half of the revenue from the solidarity surcharge.

An increase in income tax rates, on the other hand, would affect many partnerships. Although the "Corporation Modernization Act" introduced a so-called "option model", there are still some practical hurdles to its application. In this context, there is a particular need for a practical design of the retention tax relief (Section 34a EStG). Without reform, the opportunities for SMEs to build up equity would be limited, which would affect their self-financing capacity. In the medium term, this would lead to less employment and investment.

Fairness of performance as a benchmark for tax policy

The income tax rate in Germany is progressive - every additional euro earned is taxed disproportionately. Without a regular adjustment, "cold progression" occurs, whereby the tax burden increases even if an increase in income is only in line with inflation. Taxpayers with low and medium incomes are particularly affected by this. An increase in the basic tax-free allowance and a shift in the tax scale will mitigate the effect of "cold progression" and strengthen domestic demand. In the medium term, the "middle-class kink" in the tax scale should also be eliminated, as the top tax rate will apply from an income of €58,597 in 2022, which is an early stage in the process.

Modernize tax procedural law in a practical way

The fulfillment of tax obligations is associated with considerable bureaucracy for companies. Although the digitalization of payroll tax collection is well advanced, it is not yet complete. It is therefore essential to make tax procedure law more practice-oriented for companies. In the ELStAM procedure, for example, the functionality of existing procedural structures needs to be improved and new functions implemented in a timely manner.

Refraining from the wrong path of new or higher taxes

The (re)introduction of taxes is being discussed to finance the debt incurred during the coronavirus pandemic. However, instead of promoting economic recovery from the crisis, this would lead to additional burdens on companies, which would inevitably be at the expense of investments and therefore competitiveness, growth and jobs.

For example, a wealth tax would come on top of profit-related taxation and would even be levied when companies incur losses and hit companies with low liquidity particularly hard. In procedural terms, it would cause problems in the collection and valuation of business assets and has questionable constitutional conformity.

A financial transaction tax would particularly affect non-speculative transactions in the real economy: it would affect the acquisition and reallocation of investment funds for company and private pension schemes as well as financial transactions by companies that hedge currency or commodity risks. National solo efforts would distort competition in favor of markets whose transactions are not subject to taxation.