Long-term care insurance

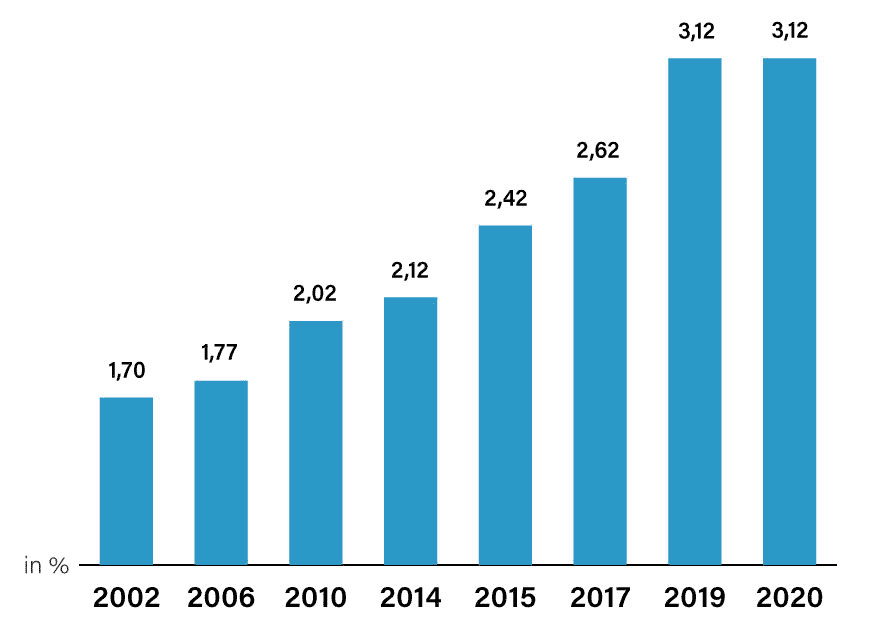

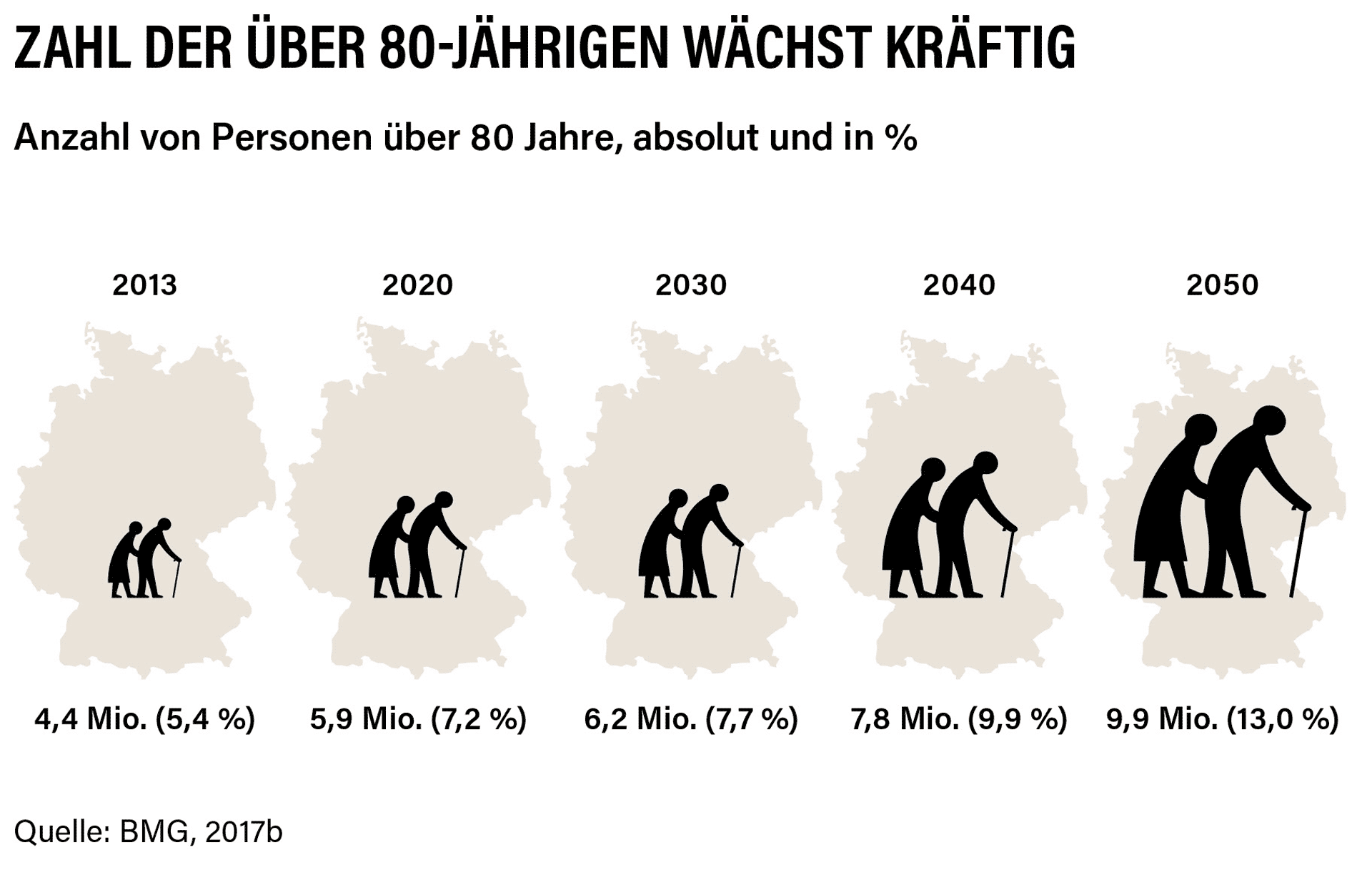

Social long-term care insurance is more affected by demographic change than all other branches of social insurance. It must therefore be comprehensively reformed on both the financing and the benefits side in order to remain efficient and financially viable in the long term.

©AdobeStock Khunatorn

Sustainable structural reforms are essential

Without a fundamental and sustainable structural reform, which must also include further development of the care infrastructure and better use of the existing social potential, the burden of labour costs due to care insurance contributions threatens to increase considerably in the coming decades. However, Germany already has a very high tax and social security contribution burden by international standards.

The central reform step must therefore be to decouple the financing of long-term care costs from the employment relationship. The best way to achieve this is to switch financing to non-income-related nursing care premiums with tax-free payment of the employer's contribution into gross wages and social compensation for those on low incomes. The current wage-based contributions act like a punitive tax on labour. If this is not politically feasible, at least the employer's contribution to nursing care insurance must be set by law at the level of the employer's contribution to nursing care insurance. The best way to do this is to switch the financing to nursing care premiums that are independent of income, with tax-free payment of the employer's contribution as part of the gross wage and social compensation for people on low incomes. The current wage-based contributions act like a punitive tax on labour. If this is not politically enforceable, at least the employer's contribution to long-term care insurance must be set by law at the 2021

Only capital cover is generation-appropriate

In order to ensure the long-term financial viability of social long-term care insurance, it is also essential to build up supplementary funded risk provision. The "Pflege-Bahr" (long-term care insurance policy) and other products are making a valuable contribution for more and more people to counteract the threat of a financial shortfall in the event of long-term care need, and are thus helping to avoid dependence on social assistance for long-term care. There is a threat of serious intergenerational redistribution in the pay-as-you-go system of social long-term care insurance.

Maintain partial cost recovery

Long-term care insurance was conceived by the legislator on the principle of partial cost coverage for good reasons: A state-organised long-term care system financed by compulsory levies must be limited to a basic level of cover in order to leave all those involved in the system sufficient room for manoeuvre.

Expanding competitive elements

It was a serious mistake to dispense with competitive elements to a large extent when long-term care insurance was introduced. The current uniform contribution rate and the existing equalisation of expenditure do not provide sufficient incentives to use contribution funds economically. Cost and quality competition should be introduced or strengthened both between the nursing care insurance funds and between the service providers.

Supporting thecare of employees'relatives

Particularly when a relative suddenly requires care, employees are often faced not only with an emotional but also with an organisational challenge. The better and more quickly the necessary advice is given to those in need of care and their relatives, the more likely it is that employers will be able to adjust their personnel planning to these requirements.

Employees should inform the employer about their situation as early as possible in order to consider together which flexible working solutions are helpful and at the same time feasible within the company. Advice from care support points (or COMPASS for those with private health insurance) can be very helpful and speed up many organisational necessities that the carer is confronted with at the beginning and sometimes