Introduction of the electronic

certificate of incapacity for work (eAU)

in the company

From January 1, 2023, all employers will have to request their employees' certificates of incapacity for work electronically from the health insurance funds. Paper reports will no longer be required. Many questions about the procedure are still unanswered at the start date.

The BDA has created a FAQ for the most frequently asked questions.

You can find out how employers can access the electronic certificate of incapacity for work without their own software on the ITSG website.

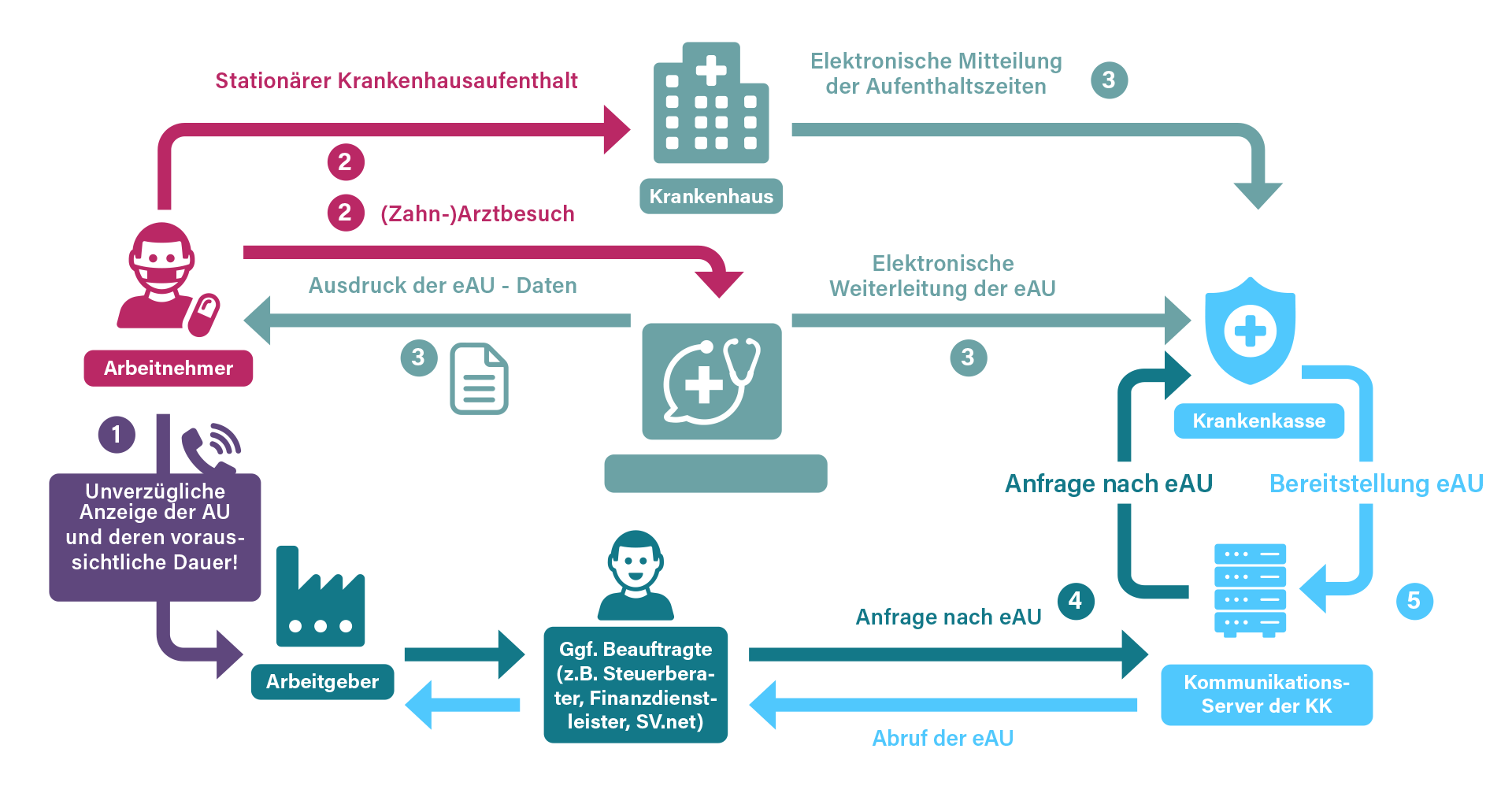

Procedure from January 1, 2023

Click on the image to download the eAU information flyer.

- The employee must notify the employer immediately of his or her inability to work. This obligation may already exist before the visit to the doctor or hospitalization. The employee must also inform the employer immediately of the expected duration of their incapacity for work.

- The employee receives a printout of the sick leave data for himself from his doctor's surgery. At his request, he will also receive a printed sick leave certificate for his employer.

- After the doctor's visit, by midnight at the latest, the doctor's practice transmits the incapacity for work data electronically to the health insurance fund. In the event of a hospital stay, the hospital transmits the stay and discharge data to the health insurance fund.

- The employer or an authorized representative (e.g. a tax consultancy firm) sends a request for the eAU to the health insurance fund via its communication server.

- After receiving the request, the health insurance fund makes the eAU available for retrieval on the communication server. The employer or their representative receives a notification that the eAU has been made available. Retrieval should be possible on the day following the medical assessment.

EXCEPTION: If the eAU has not yet arrived at the health insurance fund (e.g. because it has not yet been transmitted by the practice or there is no Internet connection at the practice), the employer or their representative will receive a corresponding error message. In this case, there may be a delay in retrieving the eAU (by post).

Legal basis

§ Section 109 para. 1 SGB IV in conjunction with § Section 295 para. 1 sentence 1 no. 1 SGB V

stipulates that from January 1, 2022, the health insurance funds must prepare a report for the employer to call up after receiving the incapacity for work data. The same applies pursuant to Section 109 para. 3a SGB IV after receipt of the expected duration and end of inpatient hospital stays (Section 301 para. 1 sentence 1 SGB V) and pursuant to Section 109 para. 3b SGB IV after receipt of data on incapacity for work in the event of accidents at work and occupational illnesses (Section 201 para. 2 SGB VII).

§ SECTION 125 SGB IV

provides for a corresponding pilot from July 1, 2021. The Act to Improve Transparency in Pension Provision and Rehabilitation and to Modernize Social Security Elections (Digital Pension Overview Act) postponed the start of the procedure and the pilot. Pilots are now permitted from January 1, 2022.

The mandatory start of the procedure was initially scheduled for July 1, 2022. Due to delays in the upstream phase between the doctors and health insurance companies, an extension of the pilot phase was approved with the Act on the Extension of Special Regulations in Connection with the COVID-19 Pandemic for Short-Time Work Allowance and Other Benefits until December 31, 2022. The mandatory start was thus postponed to January 1, 2023.

The obligation to report incapacity for work in accordance with Section 5 (1) sentence 1 EntgFG will continue to apply beyond January 1, 2023.

Retrievable certificates

Certificates that cannot be retrieved

Good to know: It only makes sense to call up the eAU if the employee is already obliged to have their incapacity for work determined by a doctor at this point in time and the doctor has already been able to transmit this to the health insurance fund.

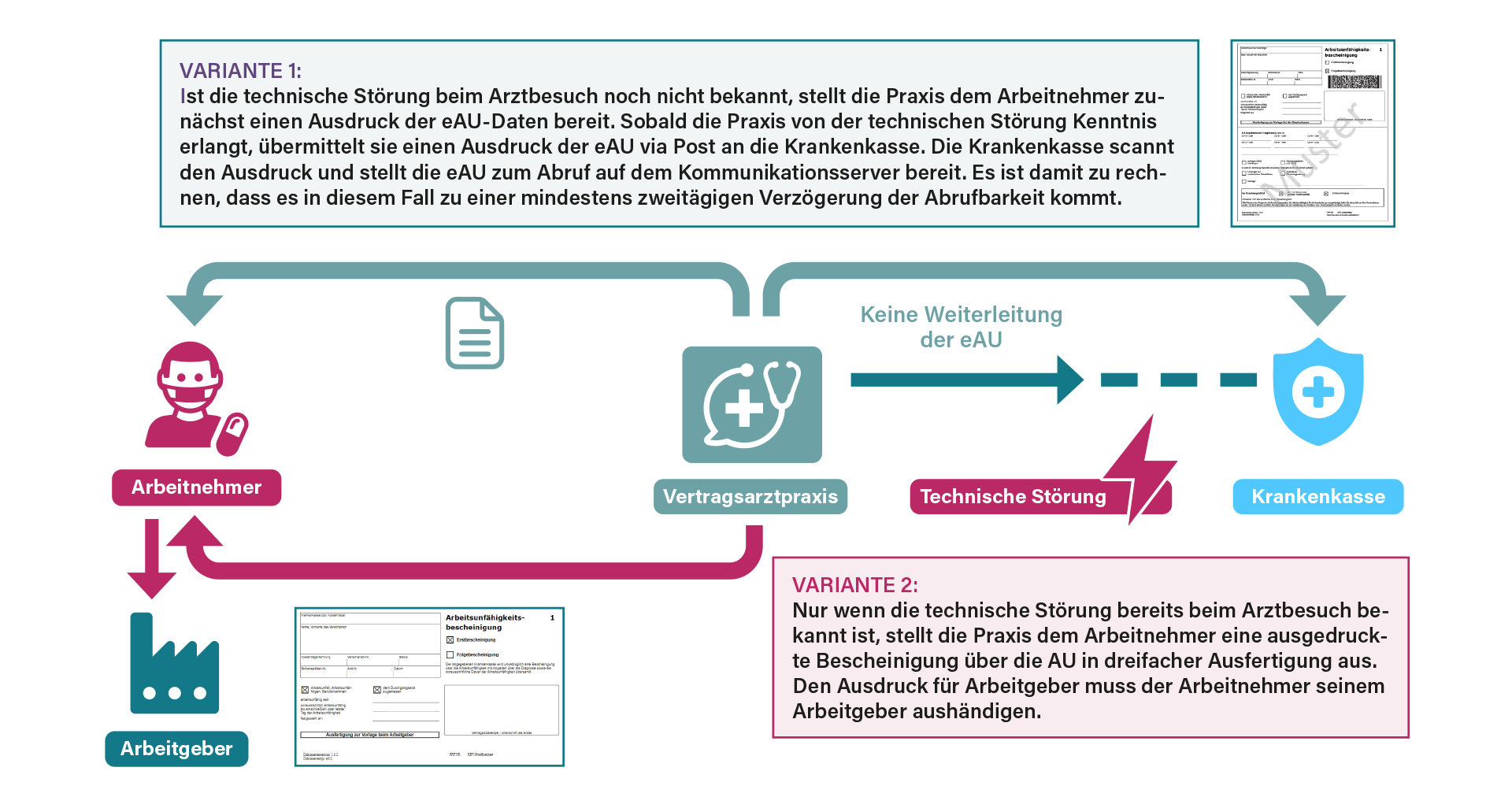

Procedure in the event of a technical fault

Click on the image to download the eAU information flyer.

- BDA | Practical seminar on eAU on January 19, 2023 >>

- BDA | Practical seminar on eAU on November 8, 2022 >>

- BDA | Practical seminar on eAU on October 10, 2022 >>

- BDA | Practical seminar on eAU on August 22, 2022 >>

- BDA | Practical seminar on eAU on July 26, 2022 >>

- BDA | Practical seminar on eAU on May 17, 2022 >>

- BDA | Practical seminar on eAU on April 4, 2022 >>

- BDA | Practical seminar on eAU on February 23, 2022 >>

Further links

![]()