Public finances

By taking on new debt as a result of the pandemic, the effects of the pandemic on the economy and jobs have been cushioned. In the meantime, the debt has added up to a large amount. To ensure that the debt does not become too great a burden for future budgets and taxpayers, politicians must comply with the debt brake again in the near future and return to a budget policy that is fair to all generations. Additional tax revenue should be used for investment and not for consumption.

Photo: AdobeStock weyo

Return to intergenerationally fair and sound public finances

Future taxpayers will have to pay today's debts through their taxes and contributions, which is why it is important to have a budget policy that is fair to all generations. At the same time, stable budgets make it possible to act in crisis situations. The debt brake and "black zero" gave Germany the financial leeway that was ultimately used during the pandemic. In order to restore the budgetary capacity to act, it is necessary to repay the debt incurred in a timely manner. This is supported by a growth-oriented economic policy and consistent spending discipline.

Consistently reduce pandemic-related debt - use fiscal rules

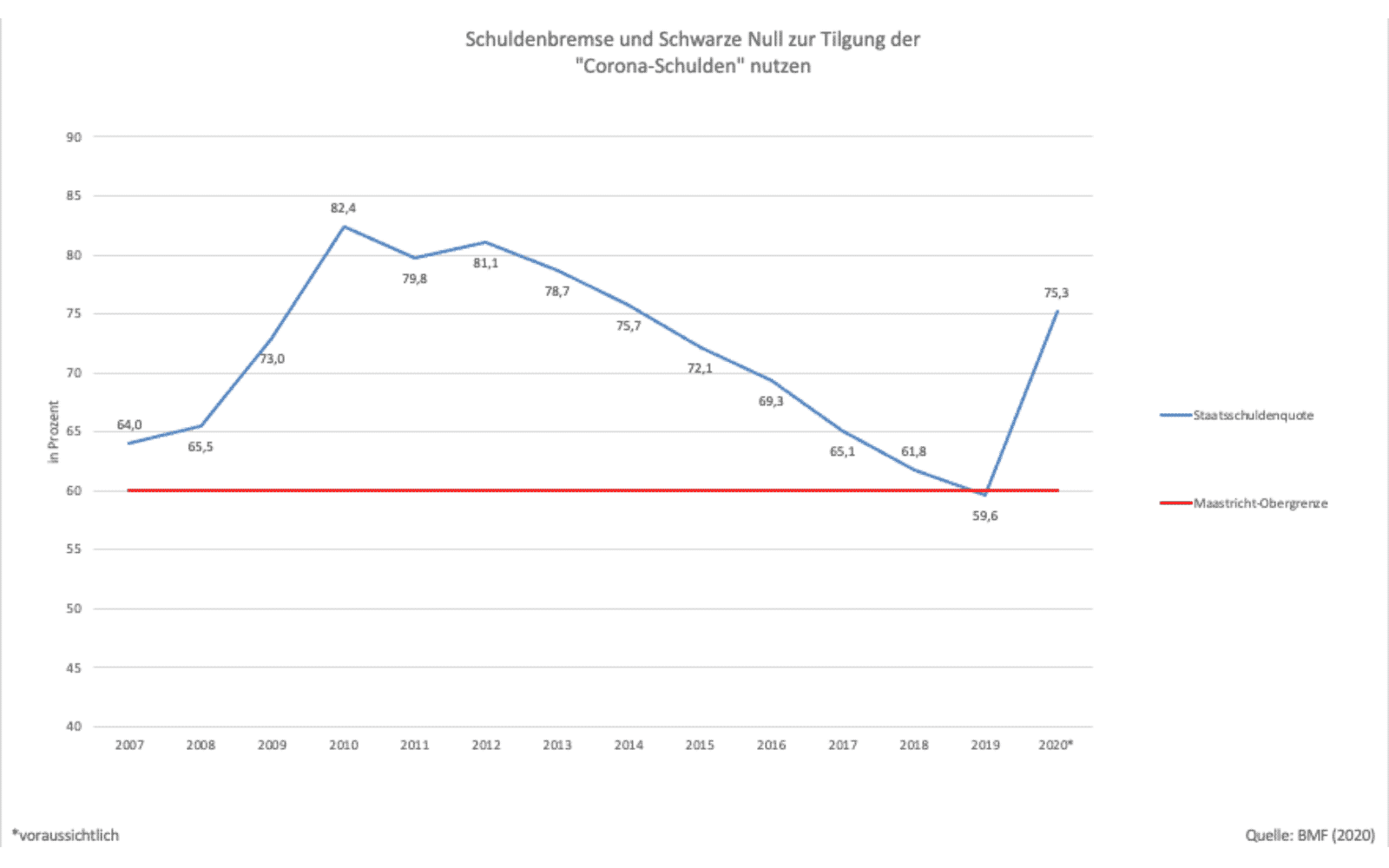

In 2019, Germany fell below the Maastricht upper limit of a government debt ratio of 60% of gross domestic product (GDP) for the first time since 2002. The government debt ratio is dependent on economic growth: if GDP increases and no new debt is taken on, the government debt ratio decreases.

Due to the economic upturn in the 2010s and the associated increase in GDP, the "corona debt" did not increase the government debt ratio as much as the debt taken on during the economic and financial crisis of 2008/2009: By 2010, the government debt ratio had grown to over 82% of GDP, while the government debt ratio is expected to rise to around 70% of GDP in 2021. However, this supposedly "smaller" increase conceals the actual amount of loans taken out.

Between 2009 and 2011, Germany borrowed around EUR 96.5 billion. If the currently planned credit authorization framework is fully utilized in 2022, Germany will take out corona-related loans amounting to around 470.4 billion euros between 2020 and 2022. Added to this is the planned special fund for the Bundeswehr (€100 billion) and the expenditure for the relief packages in connection with the war in Ukraine. By comparison, the total expenditure of the 2019 federal budget amounted to 343.2 billion euros.

To ensure that these funds, which are primarily used to overcome today's crises, do not place too great a burden on future generations, it is necessary to repay the debt promptly and comply with the debt brake again, as well as to ensure sustained economic growth.

Growth and employment stabilize public finances - debt brake no obstacle to investment

Compliance with the Maastricht ceiling, while at the same time transitioning to a climate-neutral economy, requires an economic policy geared towards growth and investment. Investments are a basis for economic growth. If companies invest in new business areas, for example, they need additional staff or machinery. Public investment provides incentives for additional private investment and ultimately triggers economic growth. This is all the more important as more than half of all macroeconomic investment expenditure is made by companies. Conversely, cutting government investment, for example to achieve budget consolidation, would be a counterproductive strategy. With investment spending of more than 255 billion euros in the period from 2022 to 2026, the federal government is sending an important signal.

The debt brake is also not an obstacle to investment, as the level of public investment spending after its introduction was higher than before, even in relation to total federal spending. A high level of public investment requires the political will to set the right priorities in the federal budget. However, as 2021 shows, the funds available for investment must also be used.

Targeted reduction of subsidies

The demand for a reduction in subsidies is a perennial issue and is also reflected in the formation of the government in the 20th legislative period. Subsidies are not just an item of expenditure in the budget. They distort prices and thus competition, encourage the misallocation of resources and can delay necessary structural change. At the same time, not every subsidy is detrimental to competition and growth, as the start-up support for new growth-promoting or fundamental technologies shows. Therefore, there is no need for a blanket reduction in subsidies, but rather a targeted reduction that does not restrict growth and the performance of the workforce.